The article covers the following subjects:

- Major takeaways

- What is Spread in Forex Trading?

- Spread Definition

- How to Calculate Spread: Bid/Ask Spread Formula

- How Spreads Work

- Forex Spread Types

- What Spreads Depend On

- How to Profit from Spreads

- Large spreads or a broker charging commissions: Which account to choose?

- Forex Pairs with the Lowest Spreads (Forex Zero Spread)

- Forex Spread Trading FAQ

Major takeaways

| Main Thesis | Insights and Key Points |

|---|---|

| Definition: | Forex spreads represent the commission by brokerages. It's the gap between buying and selling prices in the global financial market |

| How to Calculate: | Forex spreads are calculated using the BID (selling price) and ASK (buying price). The difference between these gives the spread. |

| How Spreads Work | Forex spreads indicate currency demand and supply using BID and ASK prices. They facilitate transactions in the forex market |

| Types: | Two main forex spreads are fixed and floating/variable. Each has its advantages and challenges in the forex market. |

| What Spreads Depend On: | Forex spreads depend on factors like liquidity, volatility, and geopolitical/economic tensions. These factors influence the spread size |

| How to Profit: | Traders can profit from forex spreads by understanding narrowing and widening spread positions and strategizing accordingly. |

| Which account to choose: | Forex spreads influence account choices. ECN accounts offer raw spreads, while CLASSIC accounts combine broker and exchange spreads |

| Low spreads: | Some forex pairs have low variable spreads, like EURUSD. Forex spreads vary based on market conditions and broker offerings. |

What is Spread in Forex Trading?

The spread in forex is the commission charged by brokerage firms for facilitating transactions in the global financial market.

Spread Definition

The Forex spread is a transaction fee representing the gap between buying and selling prices. When exchanging currencies, like at a bank, the selling price is higher than the buying price, creating a gap called the spread. Exchanges use the BID (selling price) and ASK price (buying price) to indicate currency demand and supply.

Spread Trading: What is this?

Spread in forex trading typically denote the commission brokers charge for executing buy or sell trades on your behalf. In global financial trading, the spread represents the disparity between the buying and selling prices of an underlying asset.

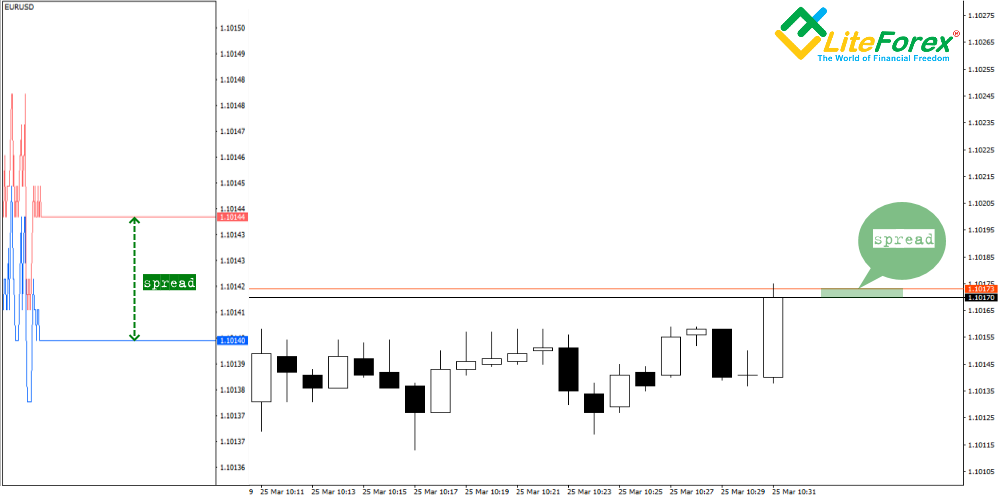

If we mean the difference between the buying and selling prices for the spread, it looks like this:

If we understand Forex spread as the difference in the prices for an asset, it looks like this:

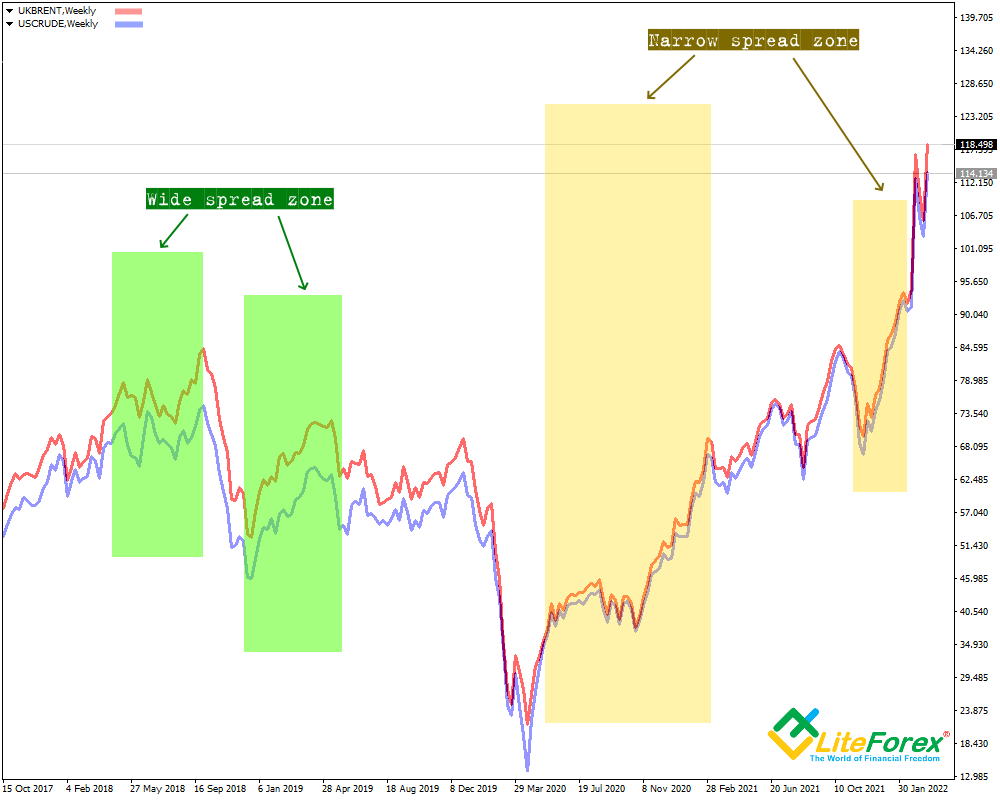

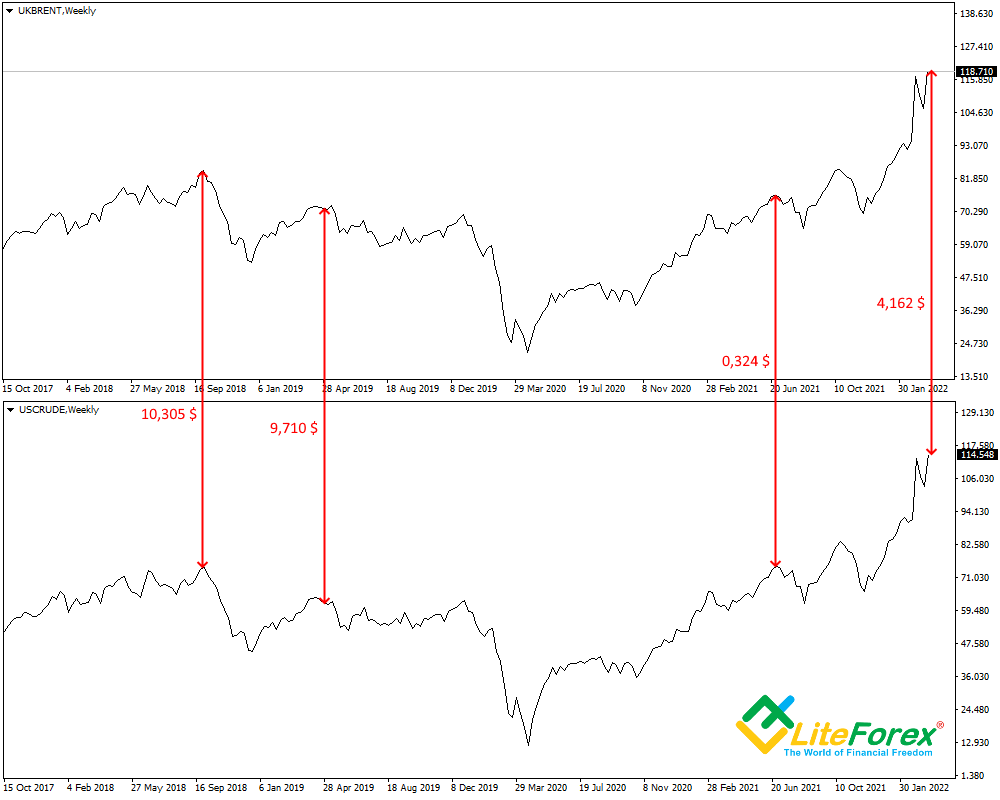

Forex traders profit from spread changes in various market conditions. Comparing assets like UKBrent and WTI, popular oil benchmarks, reveals price differences. Historically, BRENT has been pricier than WTI, with a $3-$5 average difference.

This price ratio, known as the spread position, is crucial in spread bet trading.

Narrowing Spread Position

To profit from a narrowing spread, analyse asset movement and identify average price differences. Look for instances where the range exceeds the average.

Marked on the chart are significant spread changes, with a $10 difference. Selling the expensive asset and buying the cheaper one can lead to a narrower spread difference and potential profits. Financial institutions use this strategy with deposited funds to generate profits while minimizing risk.

Widening Spread Position

To capitalize on a widening spread, identify moments when the asset value difference is narrowest. In this position, sell the cheaper asset and buy the more expensive one.

For instance, if BRENT is priced at $77.34 and WTI at $34.23, you can profit from the spread widening. As both benchmarks increase, BRENT yields a profit of $34.23, while WTI incurs a loss of $30.12, resulting in a $4.11 overall profit.

Spread Examples

Fx spreads vary based on different factors.

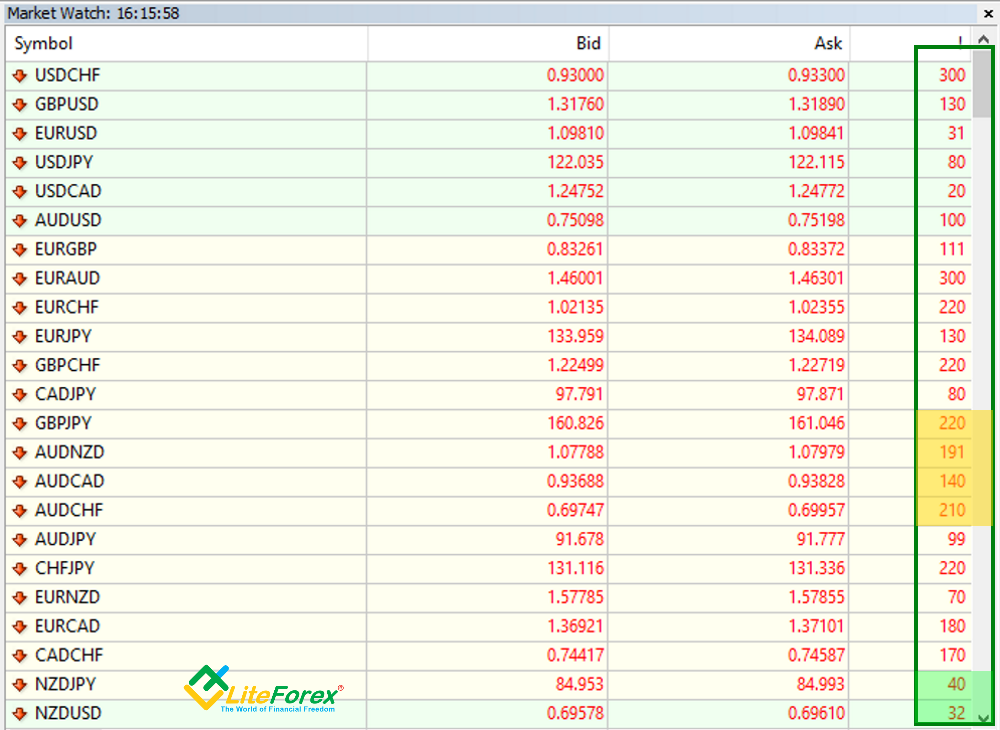

The chart above displays the spread size, BID, and ASK for each trading asset. Spreads can be narrow, ranging from 20-40 pips for some instruments, while others have wide spreads of 200-300 pips.

How to Calculate Spread: Bid/Ask Spread Formula

Calculating the spread in points is usually unnecessary, as it is available in your trading app.

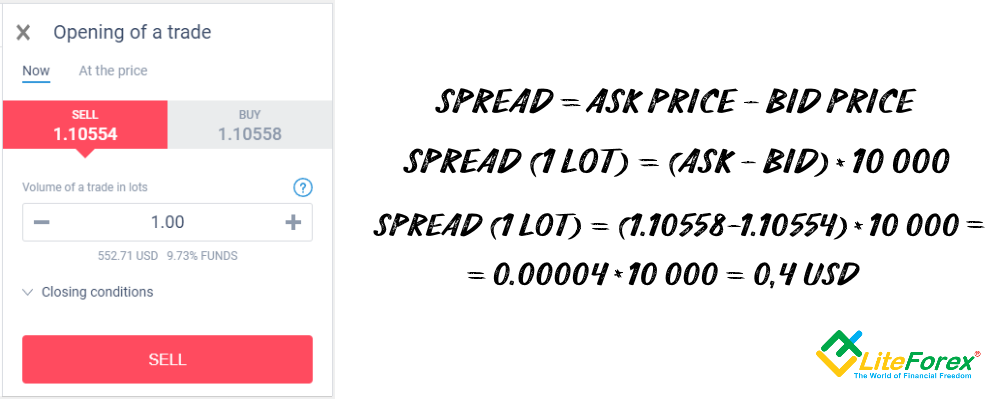

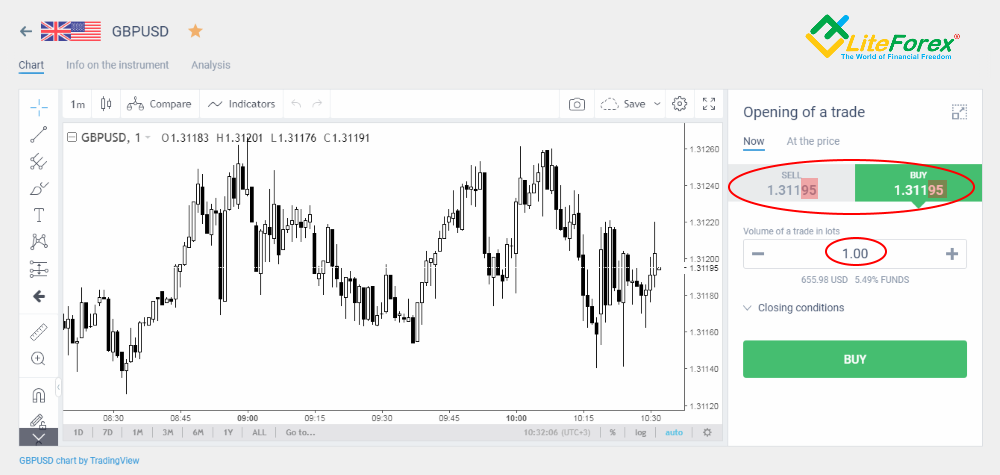

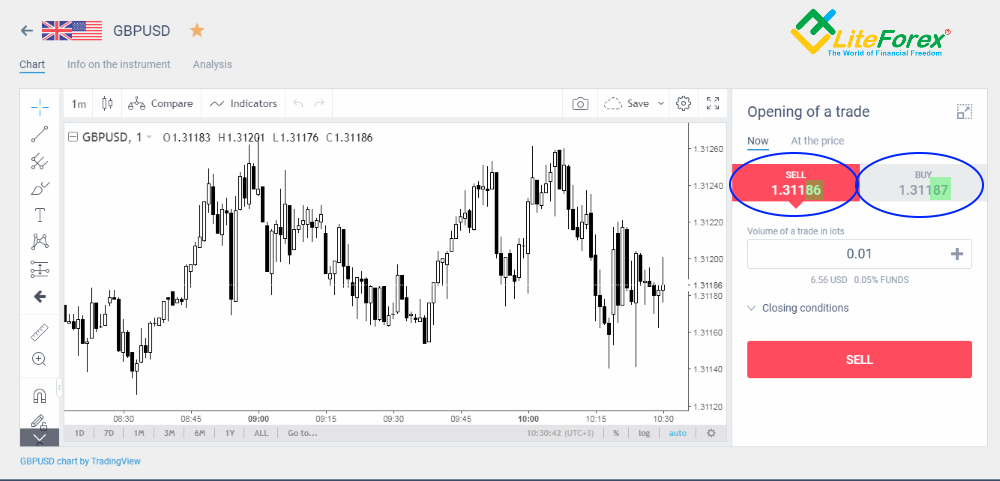

However, if you wish to convert the spread to dollars or euros, here's how to do it. You can find the BID and ASK prices in the transaction window of LiteFinance broker's app.

For example, the EURUSD pair has a Bid price of 1.10558 and an Ask price of 1.10554. The difference between these prices gives you the bid/ask spread, which in this case is 0.00004 or 0.4 pips.

Assuming US dollars, the formula is (1.10558 - 1.10554) * 10000 for 1 lot, resulting in a spread of 0.4 USD or 40 cents. For different trade volumes, adjust the currency pair units. Multiply by 1000 for 0.1 lots and by 20000 for 2 lots.

Spreads are incurred upon trade entry and exit.

How to Read Spreads

To determine spreads, look at the selling and buying prices.

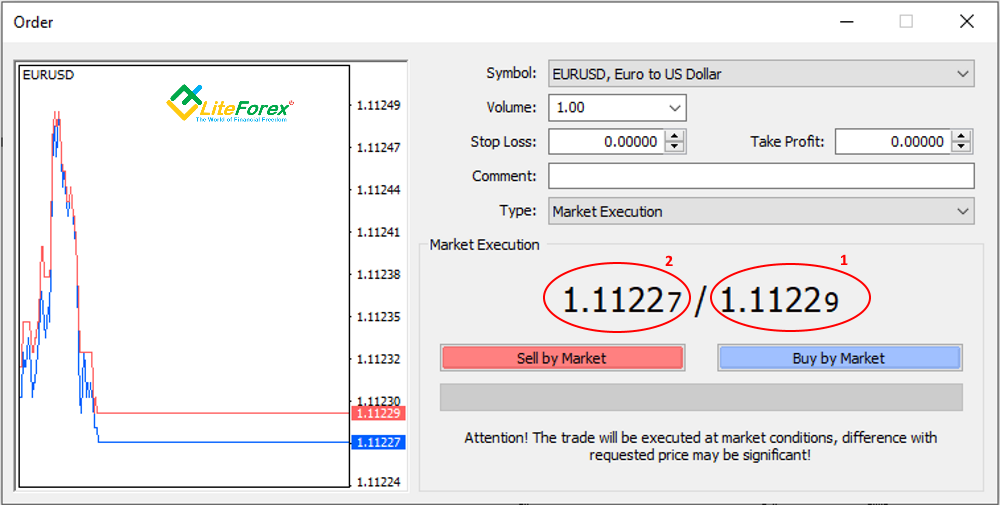

For instance, in the MetaTrader trade window, where you set transaction parameters, compare the selling and buying price. In the example, there is a difference of two pips: 1.11229 - 1.11227 = 0.00002.

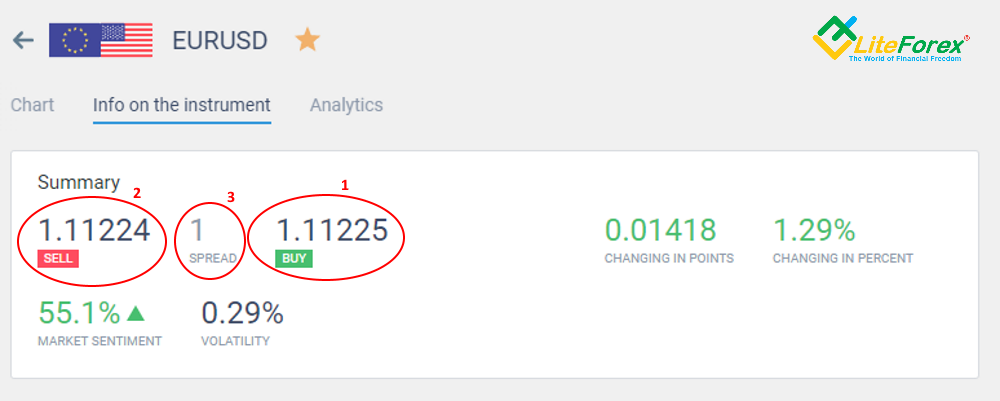

To check the spread in LiteFinance, click on the "Info on the instrument" tab.

It displays the buying and selling prices, along with the spread value. In the example, the spread is even tighter, only 1 pip.

How Spreads Work

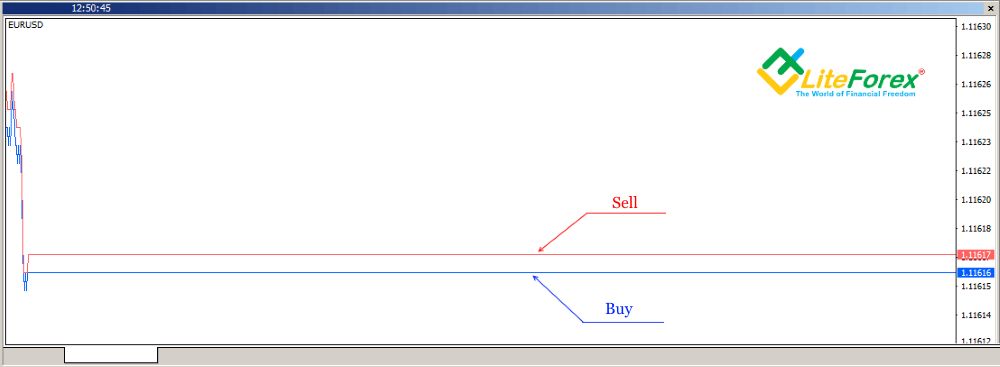

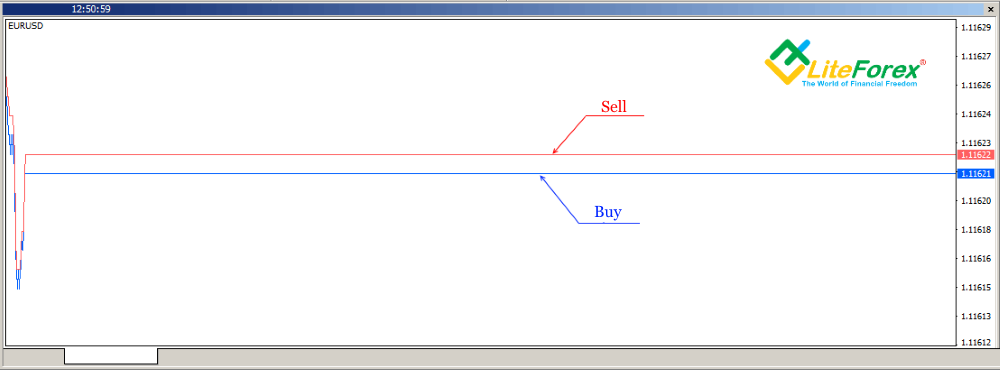

Let's examine the chart below in order to trade forex spreads effectively.

Suppose we want to buy the EURUSD currency pair, with a buying price of 1.11617 and a selling price of 1.11616. The 1-pip difference represents the gap between the prices.

When the price rises, we sell the asset at a buyer's price of 1.11621.

The total movement is 6 pips, but our profit is from the 4-pip difference. The remaining 2 pips are the spread.

The chart shows a 0 spread, possible on Electronic Communication Network (ECN) accounts, but transaction execution commissions may still apply. Spread cost is typically measured in pips and can be converted to monetary value using the pip value.

Forex Spread Types

There are two main Forex spread types: fixed and floating/variable spreads.

Fixed Spread

This spread remains constant, set by the broker, regardless of the overall market volatility. Although less common among brokers, they are favored by traders who use automated systems and scalping strategies.

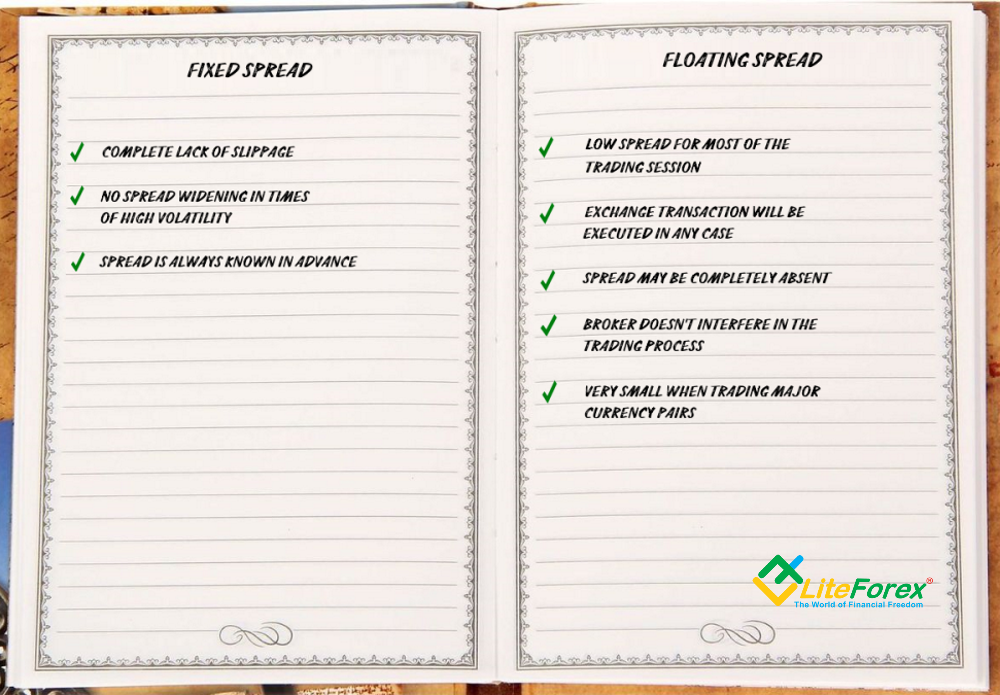

Advantages of Trading with Fixed Spreads

Trading Forex pairs with a fixed spread is becoming obsolete because offers limited advantages.

On retail investor accounts ensure full contract execution, eliminating price slippage.

They remain stable during volatility, offering stability in high volatility and low liquidity periods.

Traders using automated systems benefit from knowing the fixed spread size for making informed decisions.

Disadvantages of Trading with Fixed Spreads

Limited Broker Availability, fixed spreads are limited to less popular cent accounts, making them less available for retail investors.

Brokers offering fixed spreads consider volatility, their profit, and exchange profit, resulting in higher fixed spreads without relying on commissions.

Execution accounts with fixed spreads may experience requotes during high volatility, posing challenges for trade entry and risking disruptions for scalpers.

Floating / Variable Spreads

Floating spreads are the most common type because they adjust to market conditions. They fluctuate within a range, resembling ocean waves. Normally, they stay within 4-5 points but can widen to 50-60 points during high volatility.

Automated strategies may find it challenging to adapt, but manual trading can benefit.

The chart shows that floating spreads rarely exceed 1 pip, it shows a low spread of 0.3 pips. This is beneficial for short-term trades where spread costs are important.

Advantages of Floating / Variable Spreads

Trading with floating spreads has several benefits compared to fixed spreads. It's like sailing calm waters with occasional waves.

Variable spreads are narrow during active trading sessions and widen only during significant market shocks.

Variable spreads ensure trade execution without rejections, with the only risk being slippage.

In peaceful market conditions, there may be moments with no spread at all, especially in major currency pairs.

With No Dealing Desk technology, brokers are removed from determining spreads and quotes, ensuring interaction with real market participants and accessing real exchanges.

Disadvantages of Trading with Floating / Variable Spread

Trading with floating spreads has its drawbacks, but they can be managed with caution.

The main disadvantage is slippage. High volatility can cause trades to be executed at different prices than planned, altering entry points.

Spreads can significantly widen during periods of low trading activity, surpassing even fixed spreads.

Spread size uncertainty challenges traders using automated systems, leading to potential losses in multiple trades without precise spread knowledge.

Fixed Spread vs. Variable Spread: Which is Better?

When comparing the advantages and disadvantages of fixed and variable spreads, variable spreads emerge as the superior choice.

As seen in the table, variable spreads offer more key advantages. They enable trading with real market participants, providing opportunities for lower costs and competitive commissions. Reputable brokers offer variable spreads aligned with market prices.

I prefer trading with variable spreads, particularly with LiteFinance as my broker, where the spread size has been so minimal that I haven't considered it in my trading strategies.

What Spreads Depend On

Spread is influenced by factors like liquidity (high tightens, low widens), volatility (increased widens, decreased narrows), and geopolitical/economic tensions. Popular brokers minimize spreads to attract customers.

The formula looks as follows: Spread = stock exchange’s (bank’s) spread + broker’s spread.

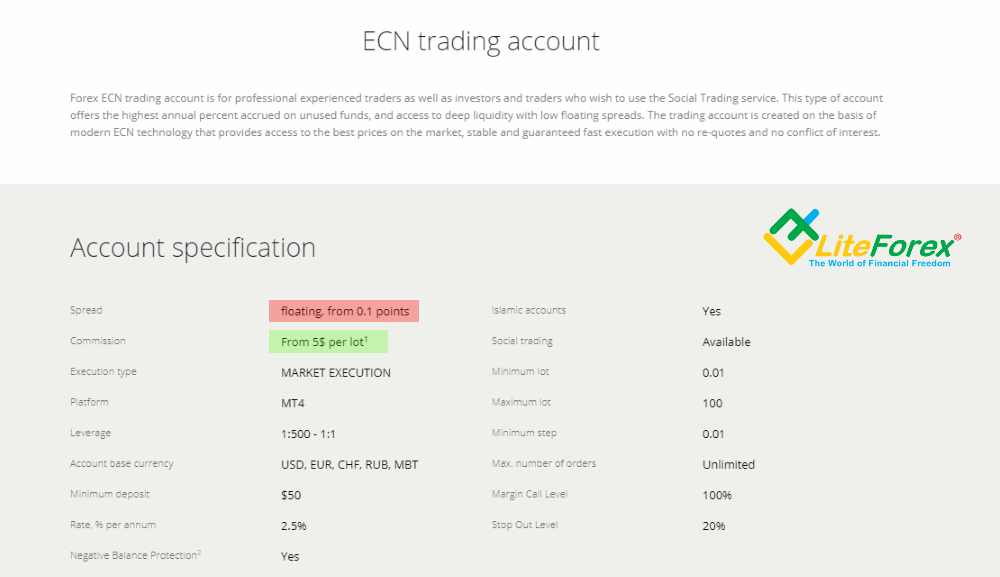

Banks charge exchange fees, brokers charge commissions. Brokers have larger spreads due to their involvement. Stock exchange charges raw spreads without mark-ups or broker additions. Trading with raw spreads has become possible thanks to ECN trading accounts.

CLASSIC trading accounts are also available, they combine the stock exchange's and broker's spreads, resulting in a larger spread compared to a raw spread.

How to Profit from Spreads

Spread rebate services in Forex offer partial profit through reimbursements. There are two types: spread rebates for CLASSIC accounts and commission rebates for ECN accounts. This service is suitable for medium-term traders, with 10-20 trades per month, but scalpers have limitations. For long-term strategies with trades over 1000 points, spread rebates have limited benefits. Personally, I focus on my long-term strategy with average profits of 3,000-5,000 points, where specific spread size becomes less important.

Large spreads or a broker charging commissions: Which account to choose?

Low spreads are desirable when choosing a forex broker, but the correlation with service quality is complex. Brokers primarily earn through commissions, and larger brokers can offer lower commissions. Profits or losses come from market transactions, and reputable brokers pay clients their rightful profits.

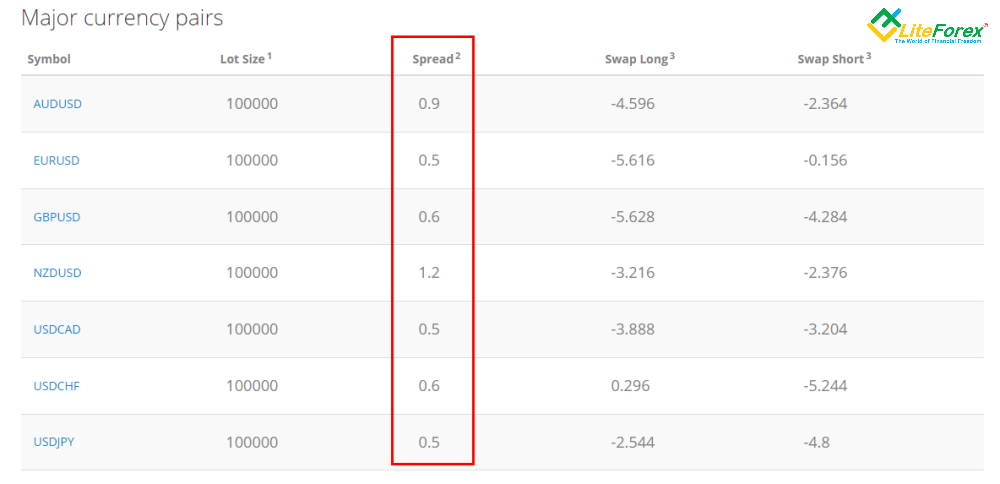

Forex Pairs with the Lowest Spreads (Forex Zero Spread)

The tightest spreads are found in ECN accounts with market execution. Here are currency pairs known for having low variable spreads:

EURUSD: Average size ranges from 1 to 5 pips or 0.1 to 0.5 points.

EURGBP: Average size ranges from 2 to 8 pips or 0.2 to 0.8 points.

GBPUSD: Average size ranges from 2 to 8 pips or 0.2 to 0.8 points.

USDCHF: Average size ranges from 2 to 9 pips or 0.2 to 0.9 points.

USDCAD: Average size ranges from 4 to 10 pips or 0.4 to 1.0 points.

EURJPY: Average size ranges from 3 to 11 pips or 0.3 to 1.1 points.

AUDUSD: Average size ranges from 4 to 12 pips or 0.4 to 1.2 points.

These figures represent averages in calm market conditions. You can check real-time spreads on the trading platform. Honest ECN brokers earn through spreads or commissions. It's essential to select a reputable broker with transparent and fair trading conditions. Beware of claims of zero spreads without clear pricing models.

Forex Spread Trading FAQ

A good spread is the minimal difference between the buy and sell price, ideally matching the raw market spread.

No. Institutional trading involves Forex trading of large financial institutions. Trading volumes and the number of trades are so large that institutions have to pay a significant premium for access to super-liquidity. As a result, the size of the spread in institutional trading increases significantly.

Search for websites with comparative tables or open demo accounts to compare real-like spreads.

Brokers offering zero spreads compensate through commissions. ECN systems provide raw spreads, but charge commissions.

Exotic currency pairs have wider spreads due to their lower popularity, higher costs, and increased risk for traders.

Brokers earn money through the spread, their fee for facilitating your trades.

Popular charting software like MetaTrader 4/5 or TradingView is suitable for spread trading on longer timeframes. TradingView allows overlaying charts, making it convenient for Forex spread trading.

Scalping is mentally draining, while medium- and long-term strategies provide more analysis time and reduce stress.

Spread in forex is the difference between the BID and ASK prices, representing the fee charged by brokers for executing trades.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.